http://www.communityrun.org/petitions/government-accountability-national-wager

www.communityrun.org/petitions/government-accountability-national-wage

I’m not here to deny you, I’m trying to tell you that you can’t increase the NewStart Allowance by just adding $100.00 to it.

Newstart and Pensions payments come from percentages, formulated from the National Average Wage the Minimum Wage also come from this.

In 2000 Prime Minister John Howard introduced GST a 10% goods and services tax without compensating the low end of the scale.

The Fair Pay Commission where then established to create the National Wage

The Fair Pay Commission made the Minimum Wage in to the National Wage no adjustment was given.

Australia we would not be demanding this $100.00 increase to Newstart had Government provided the correct National Wage.

Help me Help you sign my Petition for the correct National Wage, I guarantee you Pensions and Newstart will automatically adjust.

Thank you

Robert Paturzo-Elliott

The Big Bang

Government Accountability – National Wage | CommunityRun

— Read on www.communityrun.org/petitions/government-accountability-national-wage

Sign my Petition and help me, help you fight for what you should already be entitled to

www.gofundme.com/f/government-accountability-the-big-bang

Support me in supporting you join me on Facebook, the Big Bang in Economics or the Big Bang all welcome

The Big Bang Video

Under the guise of Work Choices, the Australian Fair Pay Commission where established to create One National Wage with the inclusion of GST.

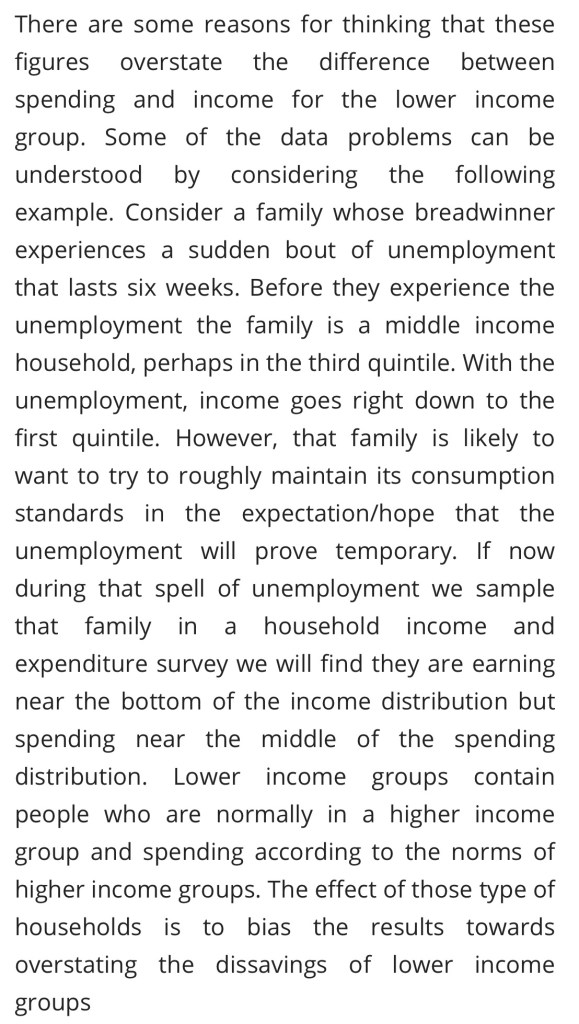

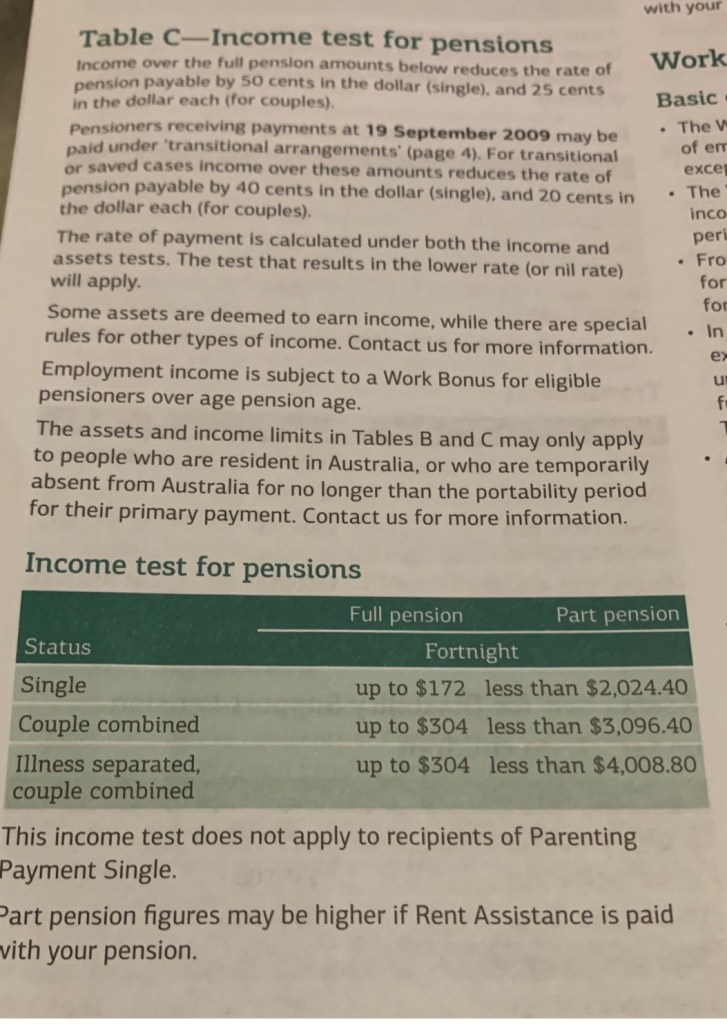

Chart C Income Test for Disability Support Pension

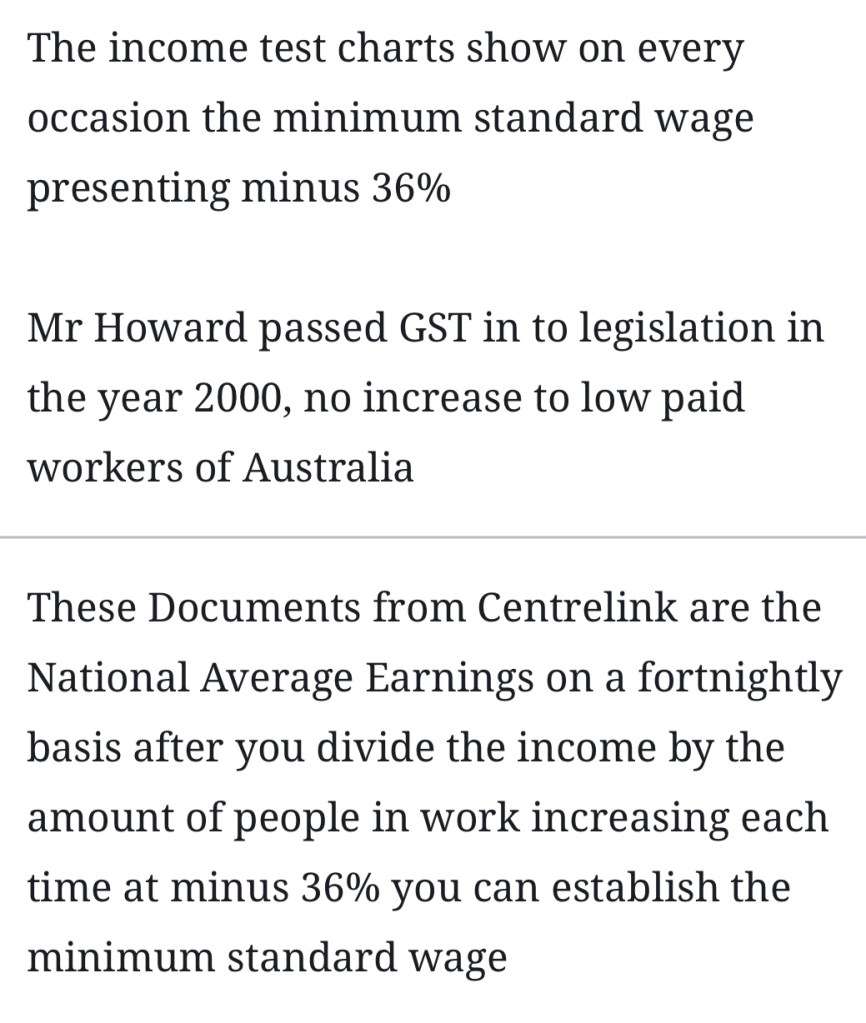

The income test charts show on every occasion the minimum standard wage presenting minus 36%

Mr Howard passed GST in to legislation in the year 2000, no increase to low paid workers of Australia

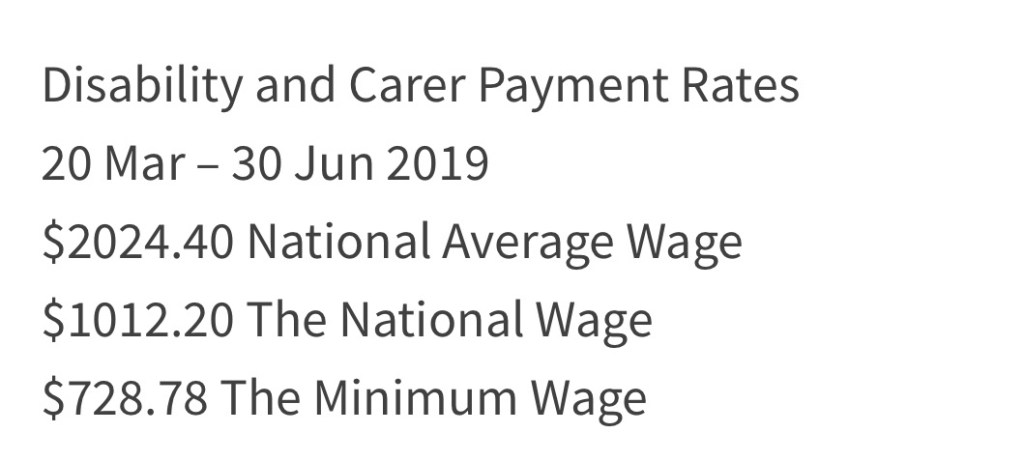

Disability and Carer Payment Rates Chart C

1 Jul – 20 Sep

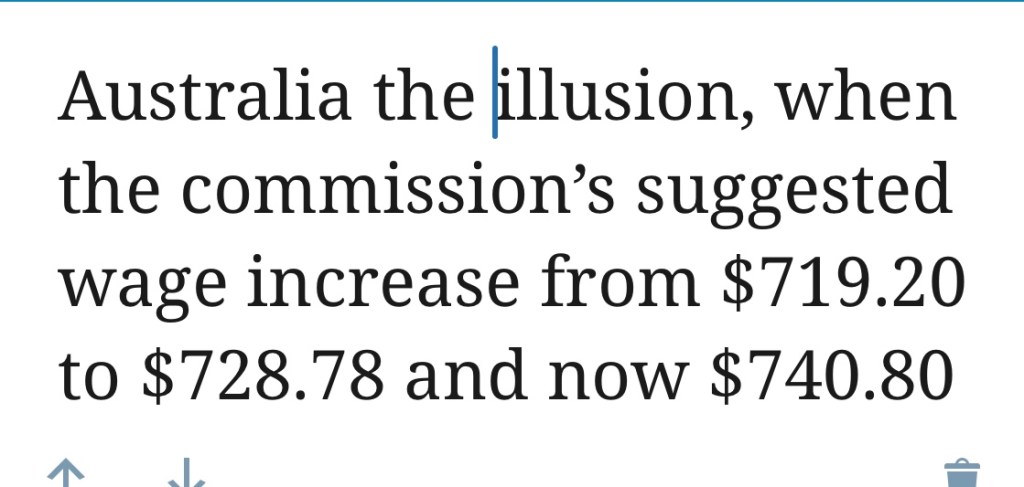

$2057.78 National Average Wage

$1028.89 The National Wage

$740.80 The Minimum Wage

GST is a 10% goods and services tax, their was no adjustment to the standard in the year 2000, 2006

The Australian Fair Pay Commission in every occasion since there inception have provided a rate commensurate to the Income Test Chart C at minus 36%

If the minimum wage is formulated automatically what are they being paid to do, in each setting of the standards multiple groups from Unions, Ministers and associations present their my question is what for if it’s automatic.

These Documents from Centrelink Chart C are what I believe to be the National Average Earnings on a fortnightly basis, they are presented 4 times per year or quarterly.

The Fair Pay Commission under the guise of Work Choices where formulated to provide One National Wage, their decision 2006 to make the minimum wage the National Wage is what I would classify as Fraud

Welfare Pensions and Newstart are demanding increase to payments of $100.00 – $75.00 only further justified that an adjustment was needed in 2006.

Please note you can not increase Pensions or the Newstart payment by just adding $100.00 or $75.00 as the are percentages that are formulated through the CPI

One National Work Place System is Equal to One National Wage and that’s is 50% of the Chart C income test for Pensions

Business SA stipulated that Mr Paturzo-Elliott evidence is irrelevant to proceedings and 2005/2006 the Fair Pay Commission didn’t even respond.

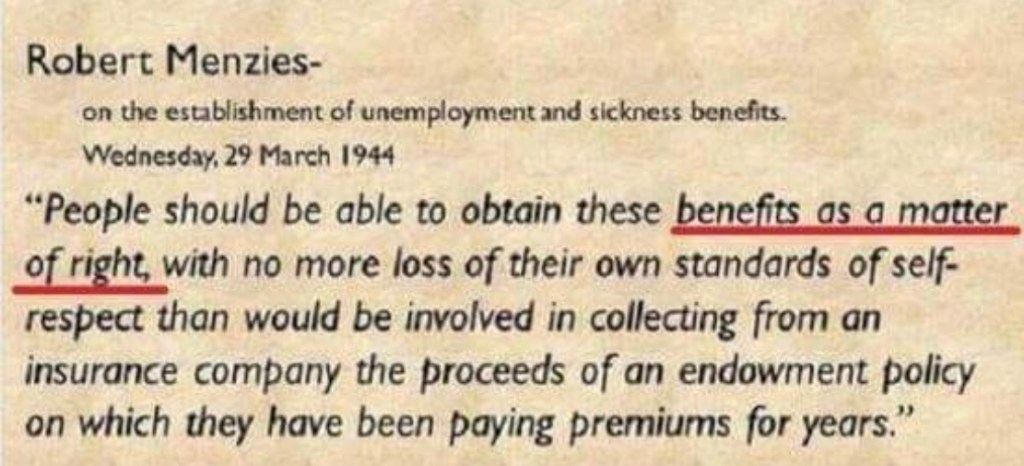

Australian Constitution A Statuette must be construed according to the intent of Parliament, Ignorance is no excuse

Occupational health Safety and Welfare, a duty of care is needed, hence no one escapes the net.

I rest my case

Join me at the Big Bang sign my Petition, or help support me in my class action at GoFundMe links below

www.communityrun.org/petitions/government-accountability-national-wage

Under the guise of Work Choices the Australian Fair Pay Commission where established in 2006, to create One National Wage.

Before

The Minimum Wage before GST in 2000 automatically formulates the Minimum Wage at 36% of the National Average Wage

After

Professor Ian Harper The Commission made their decision 2006.

The new Federal Minimum Wage is 36% of the National Average Wage.

What About GST

GST is a 10 percent tax for goods and service, collected by the Federal Government.

Anomaly

An Anomaly is occurring GST created the illusion that all Australians are earning 50% of the National Average Wage

Why it had to Adjust

The Anomaly causes a Big Bang effect as the Economy created in 1972 under Goth Whitlam does not recognise GST a 10 percent tax.

What’s Effected

State Taxes

Compulsory Work Cover

Utilities

Welfare – Newstart

Minimum Wages

Apprentice Rates

Support Wages

Housing

Interest Rates

Australian Dollar

Absolute Theory

The Australian Economy is created when we divide the population by the amount we all earn

String Theory then creates through percentages the National Averaged Wage

The National Wage at 50% and the Minimum Wage at 36%.

Centrelink

Chart C Income Test for Pensions

The figure is used as the guide, a person receiving the Pension can earn income for the National Average Wage

A pension gets paid on a fortnightly basis so then 50% would have to be the National Wage

The figures proves that the Minimum Standard wage is formulated at minus 36% of the figure in Chart C.

You must be logged in to post a comment.