Australia Prime Minister Mr John Howard and Treasurer Peter Costello introduce GST in to Legislation in 2000.

Event

Below is a list of Events directly effected by the introduction of GST in 2000

One National Work Place System

Created

The Australian Fair Pay Commission

To Create One National Wage

for Persons Injured at Work

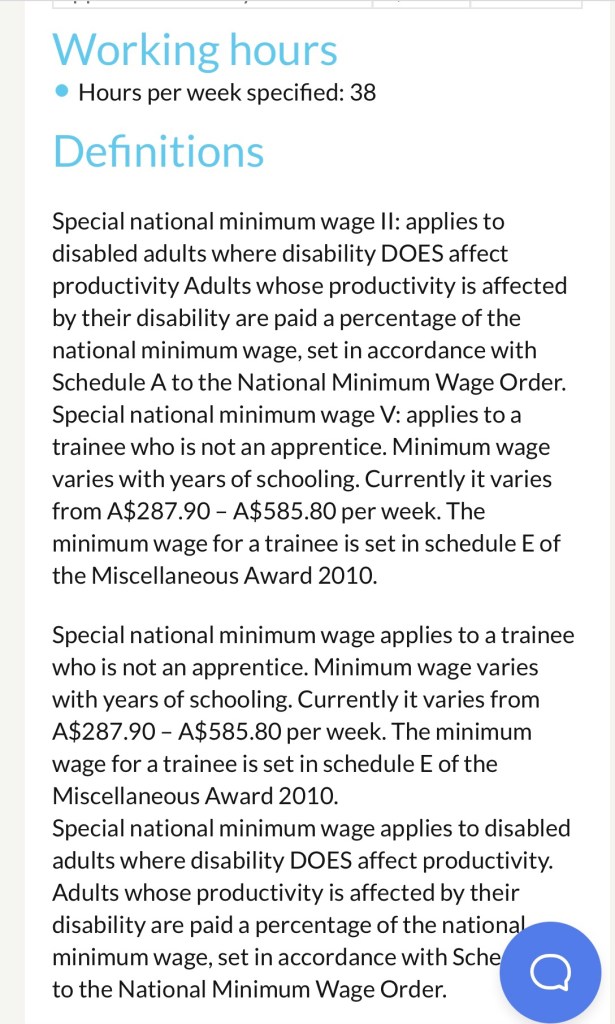

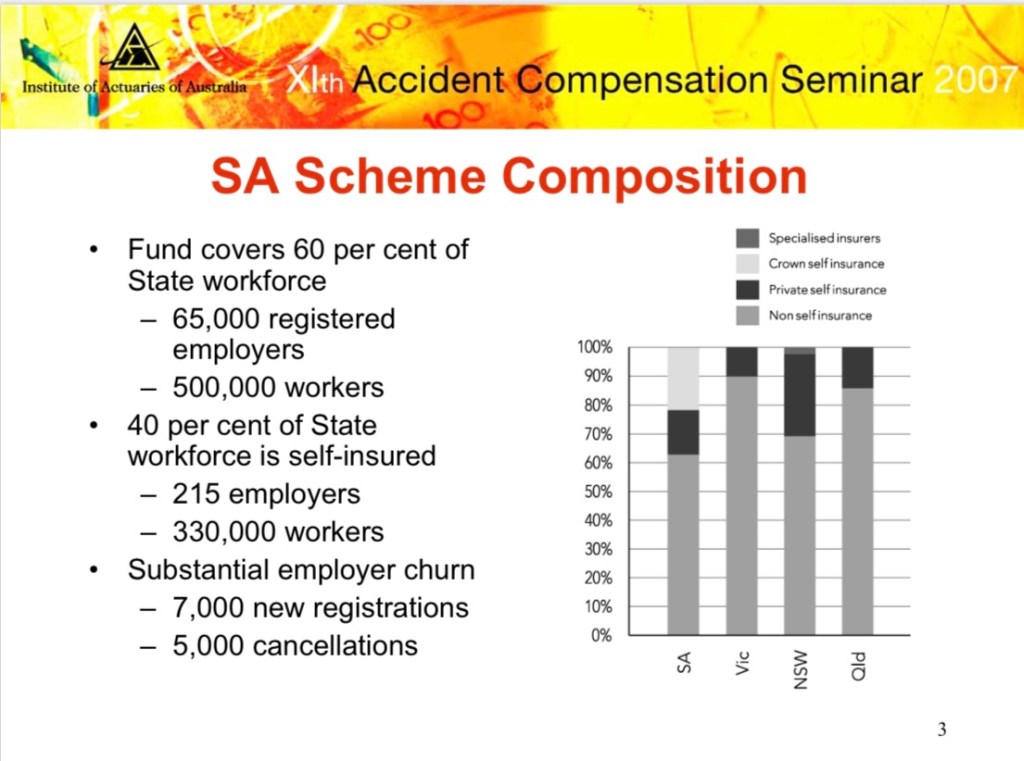

Compulsory Premiums and Fees

to cover Cost and Liabilities

Compulsory Premiums and Fees

to Cover Cost and Liabilities

to meet claims cost

Chart C Income Test for Disability Pension

National Average Earnings $2024.40 P/F

National Wage minus 50% $1012.20 P/W

Minimum Wage minus 36% 728.78 P/W

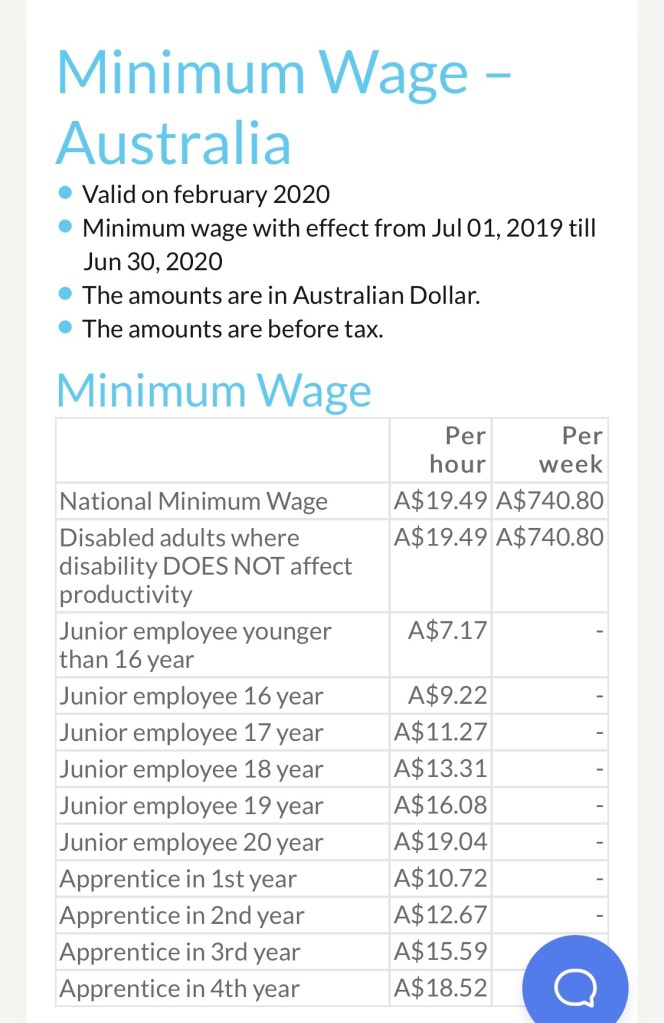

Australia’s National Wage

Chart C Income Test for Pensions/Disability a single person can earn up to $1519.50 Per Fortnight.

The figures of $1519.50 is also The National Average Wage on a fortnight basis

Their fore you would now consider 50% of this figure $747.02 to be the National Wage.

Federal Minimum Wage presented at minus 36% of $1519.50 is $547.02

Work Choices

The Australian Fair Pay Commission under the guise of Work Choices had one duty and that was to provide a National Wage.

GST has increased the cost on those most vulnerable.

Government has a duty to keep inflation and the cost of living down,

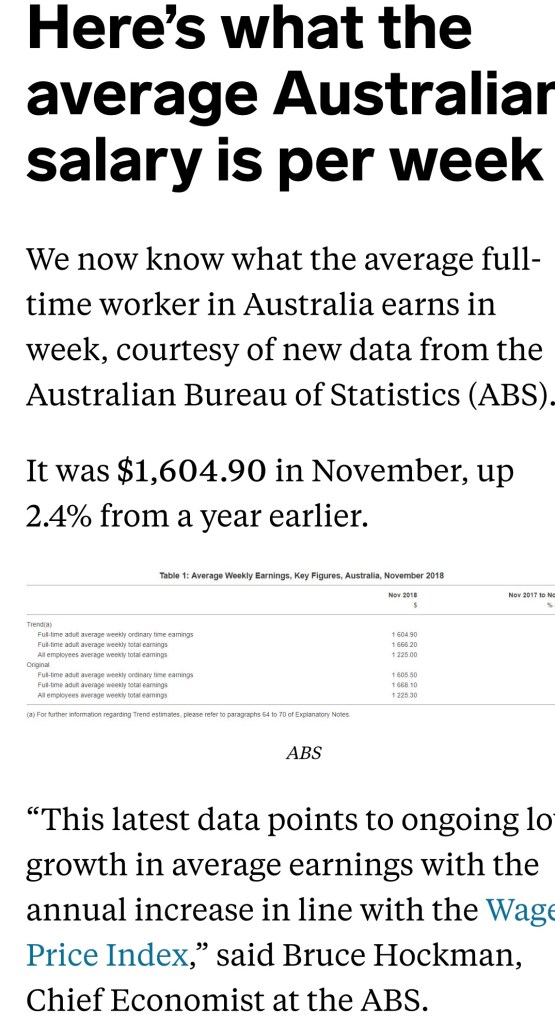

The National Wage 2019

Chart C Income Test

The 2019 National Average Wage has now increase $2024.40 from 20 March – 30 )une

The National Wage at 50% is $1012.20 and the Federal Minimum Wage 36% to $728.78

GST

An Anomaly has occurred GST is not recognised in Australia’s Economy.

The illusion is the adjusted to the National Wage had to occur in 2000, or 2006 as a duty of care was needed

The Big Bang

How do you explain this to the people, how do you fix this now.

The Figures shown reflects how Australia’s Economy formulates from a String Theory of percentages automatically formulating the Standards of our Government

The National Average Wage keeps growing, how do we stop this, simple Equal and Fair Remuneration.

You must be logged in to post a comment.