World Economics

Divide the working population by the amount we all earn

The difference between America and Australia is the size of the population

Albert Einstein

Absolute Theory can’t be wrong.

String Theory

100% The National Average Wage

90%

80%

70%

60%

50% The National Wage

36% The Minimum Wage

String Theory a series of percentages creating good governance.

World Economies joined forces in the year 1971.

GoughWhitlam created our Economy 1972.

Wage Growth, Welfare and Inflation.

A duty of care is needed the Australian Constitution

The Big Bang

Mr John Howard who has responsibility, should an injured worker be forced on to Welfare.

Introduced in the year 2000 GST is a goods and services tax.

The Economy created in 1972 as a string theory of percentages, automatically formulates the Standards.

Relativity

GST needed to be included in the Economy, adjusting the percentages needed to be considered.

Irrelevant

GST is a extra tax collected by the federal government

The Economy does not recognise GST

Anomaly

GST has caused an Illusion to the Australian Economy

String Theory formulating the standards through the percentages

The Minimum Standard Wage at 36% needed to adjust to the National Standard Wage at 50%

GST creates One National Work Place System, with One National Wage.

Work Choices

Work Choices government had a second chance at creating Australia’s first ever National Wage.

A duty of care, Australia’s Fair Pay Commission made their decision in 2006.

The Minimum Wage is now the National Wage.

A contract of employment can’t be construed unless it pays above award wages as no can receive less than the minimum standard.

GST created One National Work Place System.

The Evidence

I presented as a individual for all Australians under the Occupational Health Safety and Welfare Act.

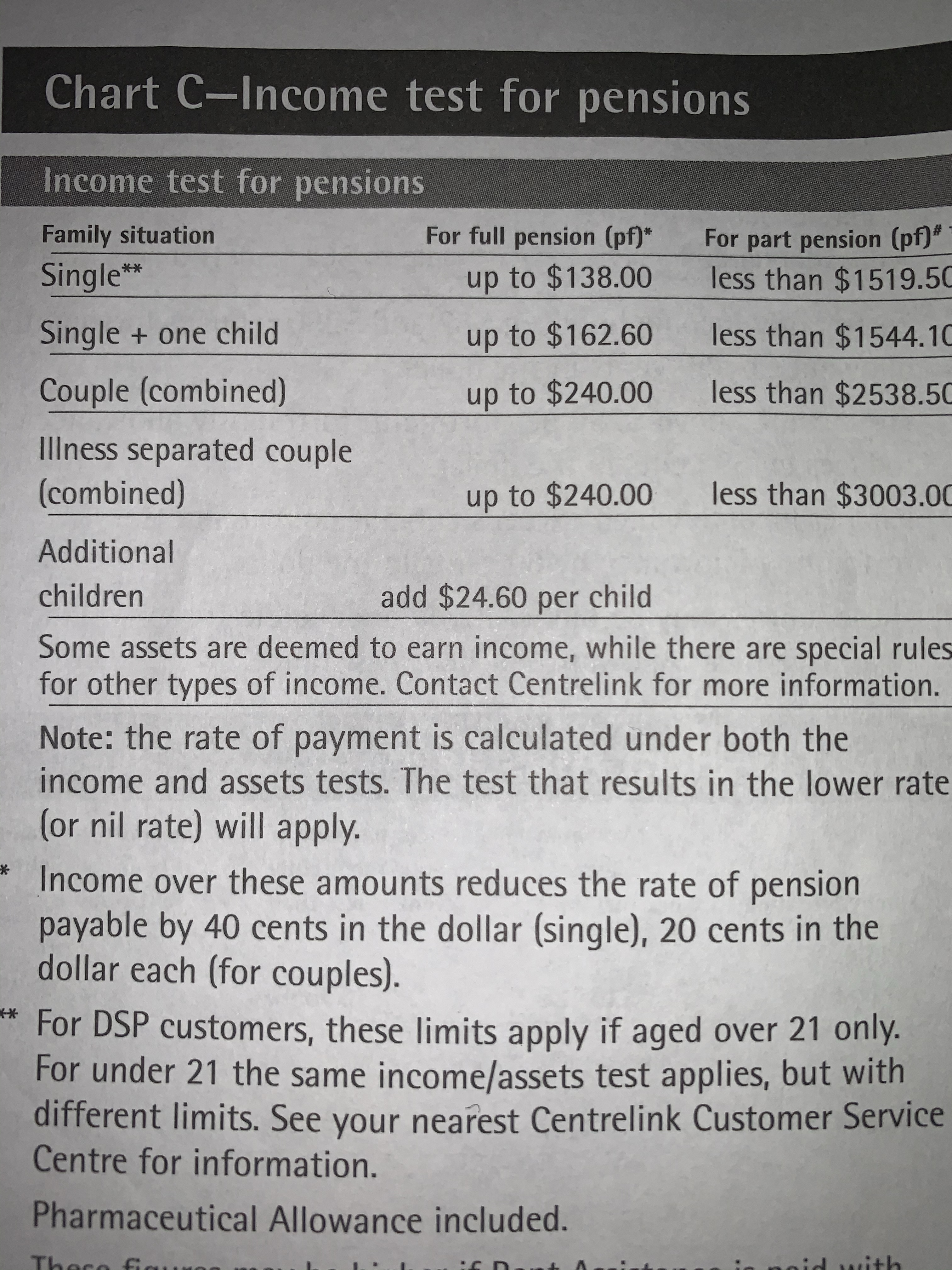

I presented documentation Centrelink, Under Chart C Income Test for pensions.

Letter to Government

Work Cover have the Sole responsibility to look after injured workers

How much should injured workers receive and what benefit could they claim

NewStart Allowance or a Disability Pension.

Newstart

To receive Newstart you must be able to look for 8 hours of work

Injured Workers ineligible to receive Newstart whilst under obligation of return to work plans

Disability Pension

I am entitled to receive the Disability Pension as a low income earner.

Under Chart C Income test for Pensions, I can receive payments from Work Cover up to $1519.50 per fortnight

I have a job to return to when I’m recovered, I was able to receive both Work Cover Payments as well as Centrelink

The sum of $1519.50 for single disability pension provides the evidence

The figure above is what I was able to receive whilst recovering

Work Cover

Work Cover compulsory premiums and fees has a unfunded liability of One Billion Dollars

6 -10 million Australians use The Federal Minimum Wage at 36% $547.20.

The National Wage at 50% is $759.75, is the solution to its unfunded liability

2005 Industrial Relations Work Cover vs Centrelink

2005 first ever minimum wage case in the state of South Australia

Work Cover have the sole responsibility to look after an injured worker, whilst collecting compulsory fees and premiums to cover cost

Work Covers Insufficient Insurance protection is a real concern.

I asked Government to fix my situation, Work Cover versus Centrelink

2005 the Income Test Chart for Pensioners showed the National Average Wage at $1422.75

The National Wage 50% at $711.37 and minus 36% the Minimum Wage $512.19

Government cannot force people under Newstart to look for 8 hours of work

I should not be receiving a Disability Pension because I was injured at work, the Work Cover Scheme have the sole responsibility.

50 Unions represented and although not educated to the extent of the Unions,

How can it be disputed the National Wage is 50% of the National Average Wage

The National Wage explains Work Covers unfunded liability.

Fair Pay Commmission

Work Choices

Mr Harper you represented God and you failed the low end, GST has no recognition in the Australian Economy.

Presenting submissions at Noarlunga Football Club 2006 in Adelaide, South Australia

No response came from the commission, Ignorance has no excuse, a duty of care was needed.

The decision of the Fair Pay Commission 2008, $21.66 increase taking the Federal Minimum Wage to $543..78

We all pay GST a 10% tax on goods and services,

Government had a duty of care, GST is a ten percent tax not recognised in the Australian Economy.

The Fair Pay Commission employed under the guise of Work Choices to provide the National Wage

Post Hoc Fallacy

When one event occurs before another event and the first event is considered the cause of the second

The National Wage $759.75

Federal Minimum Wage, is $215.97 below the correct Standard

States collect tax

Work Cover premiums and fees based on what we earn

Support Wages, Apprentice Welfare all automatically formulate from the Federal National Wage.

Utilities Water Electricity and Gas use tariffs from the percentages to formulate fees and charges.

Compensation for GST

The National Wage at 50% compensates the low end of the scale, Mr Howards GST, is ten 10 percent tax on all Australians.

The Minimum Wage is now the National Wage.

Automatically percentages formulate the standard.

The National Wage at 50% provided the solution 2005, 2006, 2008

Economics and The Big Bang, Global Financial Crisis

The Australian Dollar rose to a record high against the America Dollar $1.08 in the year 2008

Raising huge questions?

1.What made the dollar rise

2.Can the dollar split like a share.

3.If the dollar can split like a share, can it adjust back.

Take a look at the chart GST came into effect July 1 2000, the Australian Dollars rise to $1.08 American

Global Financial Crises 2008, GST is a tax, collected by the federal government.

The Economy created 1972 under Goth Whitlam does not recognise GST, revenue is not included.

Australia has a duty to keep inflation under control, GST has broken this boundary

Peter Costello

I will give you $5000 dollars to have a baby for Australia

Mr Costello wanted to fix inflation by increasing the population.

The Economy formulates by diving the population by the amount we all earn.

Increasing the population with a bribe, stop inflation

Setting the Standards

Equal, & Fair remuneration executive wages need to be brought into line, employed to do a job, their to make money for investors.

Wages

Governments position is to keep inflation low, keeping wages down.

GST is a ten percent tax demanding wage increases across the board.

Who Missed Out

Welfare – Newstart, Pension – Minimum Wage earners, not receiving increases in the year 2000.

State Taxes if the minimum wage earners, are receiving less than the correct wage, States will not be receiving correct taxes

Work Cover – Bankrupt the scheme collects premiums and fees to cover cost.

Utilities Water, Electricity and Gas use the tariffs

Double Whammy

Tax Cuts effect the states not Federal Government whom recieved GST

Illusion

The Illusion created is that the Economy is strong, but those at the low end of the scale have fallen behind.

No one is looking, GST has passed through, and prices are rising to extreme.

GST is not recognised in the Economy – The minimum wage needed to be adjusted to the National Wage 2000.

Absolute Theory

It’s now 2019, and the cost of living in Australia is out of control, government are speaking to you in another language, irrelevant

GST wouldn’t be a problem but they didn’t adjust the percentages in 2000, and then again in 2006 when given a second chance.

Inflation

Government will tell you about GDP and others, but nothing relevant on how wage growth is the cause of inflation

Australia those whom are representing us have failed in their duty of care.

The National Wage needed to be adjusted to 50% in the year 2000.

Anomaly has now created an illusion.

Mr Howard also said he would never pass GST.

Federal Minimum Wage 2019

1 July 2019

The Federal Minimum as presented by the Fair Pay Commission 1 July 2019

If the minimum wage was minus 36% of the National Average Wage $2057.78

2019 The Federal Minimum Wage $740.80

That’s what the income test charts should show in 2019 unless they tampered with them

Politics

The National Wage at 50% in 2019 should be $1028.89

The National Average Wage keeps rising, the National and Minimum Wage will automatically adjust.

Political Parties are calling for a $75.00 increase to Newstart on 17 September 2018 and again 17 July 2019

Newstart is a percentage of the Federal Minimum Wage you can’t just add $75.00

The Economy can be not be changed like that Newstart is formulated from Federal Minimum Wage.

2005 State Wage Case

The Australian Economy a string theory, created when dividing the population by the amount we all earn

What I was presenting was already in governance, the National Wage is their 50%

I stood up for us, transcript into the first ever minimum wage case 2005, every word I spoke in this case can’t be disputed.

The percentages created our standards for 28 years, the position of government is to keep the cost of living and inflation down

The National Average Wage is established in Chart C income test for Pensions divide this by 50% you have the National Wage, at 36% we had the Minimum Wage

Wages keep rising for those whom are receiving above award wages, executives wages, what about Equal Remuneration.

The income charts showed a pattern of how simply the Economy formulates from the percentages.

A duty of care was needed I was providing evidences that showed GST needed to be adjusted in to standards.

I didn’t just present a big, problem for government I was providing solutions.

State Taxes – Fixed

Work Cover – can now collect their correct fees and premiums to cover cost having sole responsibility to look after an injured worker.

Minimum wage earners, Apprentices would now receive the correct wage and entitlements

Welfare – welfare rates and apprentice rates formulate automatically adjusting to the standard

Work Choices can only be correct if you provide the correct National Wage

Contractor and employee relationships, negotiate a contract into an award.

Only Employees who earn more than minimum wage can sign a contract of employment as no one is allowed to receive less than the minimum standard.

Government spent billions denying Absolute Theory, it couldn’t be wrong, it’s all ready their, a duty of care was needed.

You must be logged in to post a comment.